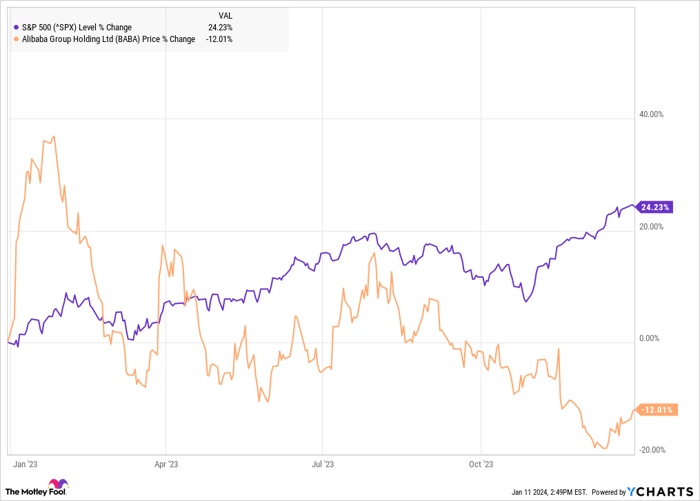

Alibaba (NYSE: BABA), the Chinese e-commerce giant, faced a tumultuous year in 2023. The anticipated recovery in the Chinese economy did not materialize, and the company grappled with losing market share to its competitors. Additionally, its plan to divest its non-core businesses faced setbacks due to new U.S. chip export restrictions, resulting in a 12% decline in the company’s stock value over the year, according to data from S&P Global Market Intelligence.

Despite initially showing promise, the stock’s performance took a downward turn, as captured in the chart below.

Challenges Faced by Alibaba

Alibaba’s stock initially soared in 2023, with high hopes for a market resurgence in Chinese stocks and a positive outlook on the company’s prospects. However, the excitement was short-lived as investor sentiment dampened in anticipation of the company’s earnings report in February. The trend continued with Alibaba reporting modest revenue growth of 2% for the December quarter, while controlling costs contributed to a 14% increase in earnings per share.

Despite a temporary rebound following a plan to restructure the company, the stock remained volatile throughout the year. Concerns about U.S. export controls on chips further weighed on the stock, with shares fluctuating through the third quarter. The stock also experienced a significant plunge in November, prompted by the company’s decision to halt the planned spinoff of its cloud computing business due to the uncertainties created by the U.S. export restriction rules.

Image source: Getty Images.

Prospects for Alibaba

In 2024, Alibaba’s stock continues to face challenges, with no immediate signs of a turnaround. The company is grappling with a weakening Chinese economy and fierce competition, particularly from PDD Holdings. Despite improving revenue growth, investors remain cautious about Alibaba’s ability to achieve sustainable growth, especially given the existing external uncertainties.

With these headwinds in mind, potential investors evaluating Alibaba stock need to carefully consider the company’s trajectory and its ability to navigate external pressures.

Should you invest $1,000 in Alibaba Group right now?

Before you buy stock in Alibaba Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alibaba Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 8, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Goldman Sachs Group. The Motley Fool recommends Alibaba Group. The Motley Fool has a disclosure policy.