Advanced Micro Devices (NASDAQ: AMD) witnessed a robust 5.3% surge in its share price during Friday’s trading session, as reported by S&P Global Market Intelligence data. While no specific company-related news surfaced, AMD’s stock hike aligned with the recent optimistic signals around AI demand and growth potential. The latest quarterly report from Dell, released after Thursday’s market closure, served as a key catalyst behind this positive momentum for AI stocks.

Dell’s Q4 Performance Sparks Bullish Sentiment Towards AI Stocks

Delivering results that exceeded expectations, Dell disclosed non-GAAP earnings of $2.20 per share on $22.3 billion in sales for the fourth quarter. These figures outperformed the average analyst estimates, causing a significant uptick in investor confidence. Dell’s strong performance in AI server products also hinted at robust growth potential extending into 2025.

On the back of Dell’s stellar performance, its stock soared by 31.6% at the end of Friday’s trading, triggering a ripple effect on the valuations of top AI players. AMD’s stock has now surged by 37.5% throughout 2024 and an impressive 158% over the past year.

Future Outlook for AMD Stock

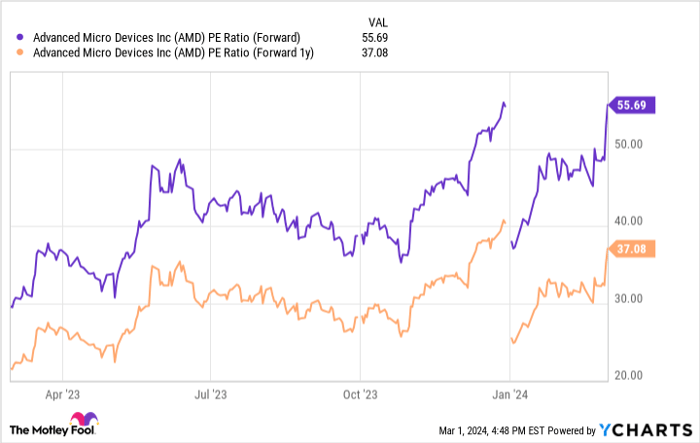

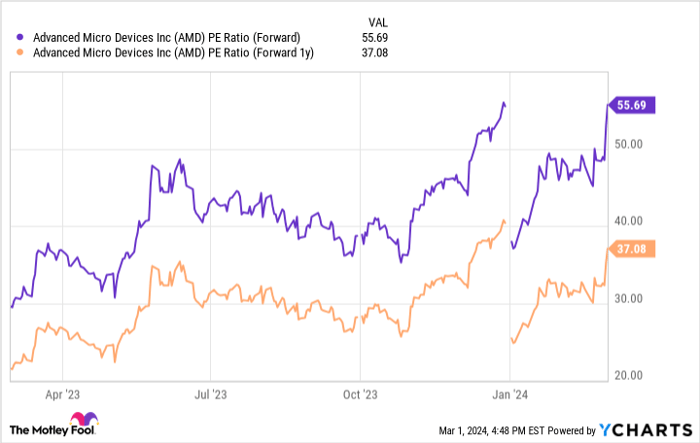

AMD’s stock has been on an extraordinary rally, primarily fueled by excitement surrounding the company’s prospects in the AI realm. With current shares trading at 55.7 times this year’s expected earnings and 37 times next year’s anticipated profits, investor anticipation remains high. While AMD’s sales forecast for the first quarter of this year hovers around $5.4 billion, indicating a relatively stable year-over-year performance, market optimism suggests that the company’s growth trajectory is poised to accelerate in the near future.

AMD PE Ratio (Forward) data by YCharts.

Investors are now presented with an intriguing conundrum – where to allocate their precious capital in the current market scenario. The evolving landscape of AI stocks, led by performers like AMD, demands a keen eye for seizing profitable opportunities. Dell’s recent success story has infused renewed vigor into the market, setting the stage for further exciting developments.

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices. The Motley Fool has a disclosure policy.