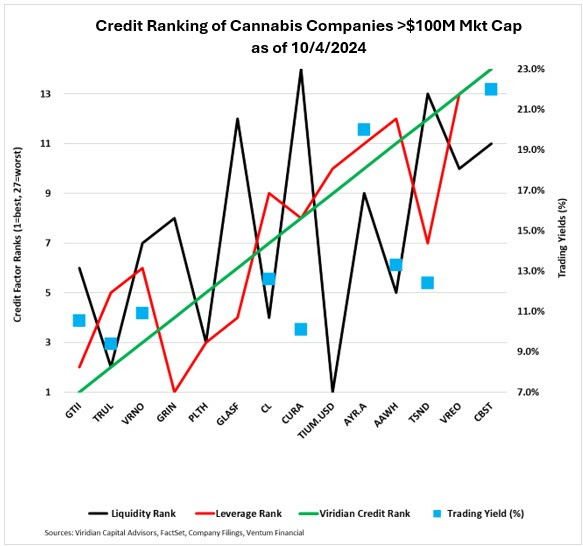

Florida’s upcoming decision on recreational cannabis has set the stage for a high-stakes opportunity for investors. The renowned Viridian Credit Tracker has identified AYR Wellness, trading as AYRWF on the OTC market, as a standout buy with a tantalizing 20% yield, largely thanks to its dominant foothold in Florida’s cannabis sector. As the possibility of recreational cannabis legalization in Florida looms large, AYR emerges as a prime target for investors seeking to capitalize on the potential windfall before the crucial vote.

AYR Wellness Offers 20% Yield: Capitalize on Florida’s Potential Vote

Viridian’s Credit Tracker underscores AYR’s strategic edge in the Florida market, positioning the company favorably ahead of the state’s likely embrace of recreational cannabis. AYR’s robust 20% yield outshines many competitors, promising significant valuation growth should Florida give the green light to recreational cannabis. This makes AYR a savvy bet for investors positioning themselves before the decisive vote.

Cresco Labs vs. Curaleaf: A 250 Basis Point Difference

The report highlights a compelling trading strategy of purchasing Cresco Labs (CRLBF) at a 12.6% yield while divesting from Curaleaf (CURLF) at 10.1%, a move that offers investors a 250 basis point yield upgrade. This strategic shift is underpinned by Cresco’s strong financials and improving credit standing, making it an appealing option for investors seeking enhanced returns and financial stability.

TerrAscend: Why 12% Yield Might Not Be Enough

On the flip side, TerrAscend (TRSSF) stands as a sell recommendation due to its 12% yield falling short in comparison. Despite its notable presence in the cannabis sector, TerrAscend’s lower yield and limited exposure to Florida’s growth prospects position it as a less compelling choice when weighed against AYR’s potential.

Cannabist Faces Liquidity Challenges

While top stocks boast attractive spreads, Cannabist (CCHWF) emerges with the weakest credit profile in the cohort, primarily due to liquidity worries following recent asset divestitures. Investors should take heed of Cannabist’s inferior credit rating, which may hinder its short-term upside despite prospects for future improvements.

Take Action Now: Florida’s Vote Could Change the Game

Amid Florida’s expanding cannabis marketplace, savvy investors eyeing maximum returns are advised to consider a strategic pair trade: acquiring AYR at 20% while shedding TerrAscend at 12%, and exploring the merits of Cresco Labs at 12.6% compared to Curaleaf at 10.1%. The impending vote holds the potential to reshape the cannabis stock landscape, making pre-vote action pivotal for those seeking substantial financial gains.

Seizing the moment before Florida’s crucial vote could mean the difference between a fruitful investment or a missed opportunity. Stay informed, stay proactive, and position yourself wisely in the dynamic world of cannabis investments.

Market News and Data brought to you by Benzinga APIs