The Resilient Rise of eBay Stock

E-commerce titan eBay Inc. (NASDAQ: EBAY) stands as a stalwart in the digital domain, pioneering online auctions and sales for nearly three decades. While once a playground for hypergrowth, eBay now stands as a beacon of stability in the fickle waters of the internet, boasting profitability, a robust balance sheet, and enviable liquidity.

Competition abounds in the realm of online markets, with eBay vying against industry heavyweights such as Etsy Inc. (NASDAQ: ETSY), Amazon.com Inc., Mercari Inc. (OTC: MCARY), and Alibaba Group Holding Ltd.

The Allure of the Collectibles Market

eBay shines as a hub for collectibles enthusiasts, charging sellers a 13% fee on successful transactions. From rare comic books to sought-after Funko Pops, the platform draws in aficionados worldwide. Notably, collectibles ranked as the second-largest contributor to eBay’s gross merchandise volume in its most recent earnings report.

Forge Ahead with PSA: Grading and Authentication

Collaborating with Collectors, eBay has cemented partnerships with Professional Sports Authenticator (PSA), a renowned grading and authentication service. By integrating PSA’s services, eBay empowers sellers to list and sell graded items directly from the PSA vault, streamlining the transaction process.

The acquisition of Goldin Auctions, a premier collectibles auction house, further cements eBay’s commitment to the collectibles market, notably highlighted in the popular Netflix series “King of Collectibles.”

Revitalizing Through Refurbished Inventory and Recognition Guarantees

eBay’s strategic expansion into refurbishing now extends to golf clubs, alongside collaborations with leading brands like Dyson and Seagate Technologies Holdings plc (NASDAQ: STX). Noteworthy is eBay’s Authentication Guarantee Program, having authenticated over 10 million items, including exclusive Air Jordan sneakers.

Embracing innovation, eBay introduces a “click-to-resell” feature in partnership with Certilogo, catering to the thriving pre-owned market.

AI and ML: The Cornerstones of eBay’s Success

eBay’s investments in artificial intelligence (AI) have paid dividends, with the introduction of a cutting-edge supercomputer elevating the platform’s capabilities. Leveraging generative AI, eBay enhances listings, enabling sellers to craft detailed item descriptions effortlessly. The introduction of Shop the Look further enhances the buyer experience, offering curated outfits tailored to individual preferences.

Magical Listings: Redefining the Selling Experience

eBay’s transformative Magical Listing Tool streamlines the arduous listing process, automating descriptions and details upon image upload. CEO Jamie Iannone emphasizes ongoing enhancements to this tool, aiming to further simplify the selling journey.

Steady Growth and Strong Financials

eBay’s Q2 2024 earnings showcase resilience, surpassing analyst expectations with revenues of $2.57 billion and operating cash flow of $367 million. Active buyers remain steady at 132 million, with revenue diversification evident in the robust performance of eBay Motors Parts and Accessories segment.

Despite repurchasing $1 billion of its shares and paying dividends, eBay boasts $6.3 billion in cash reserves, underscoring its financial stability.

Looking Forward: Mixed Guidance and Stock Analysis

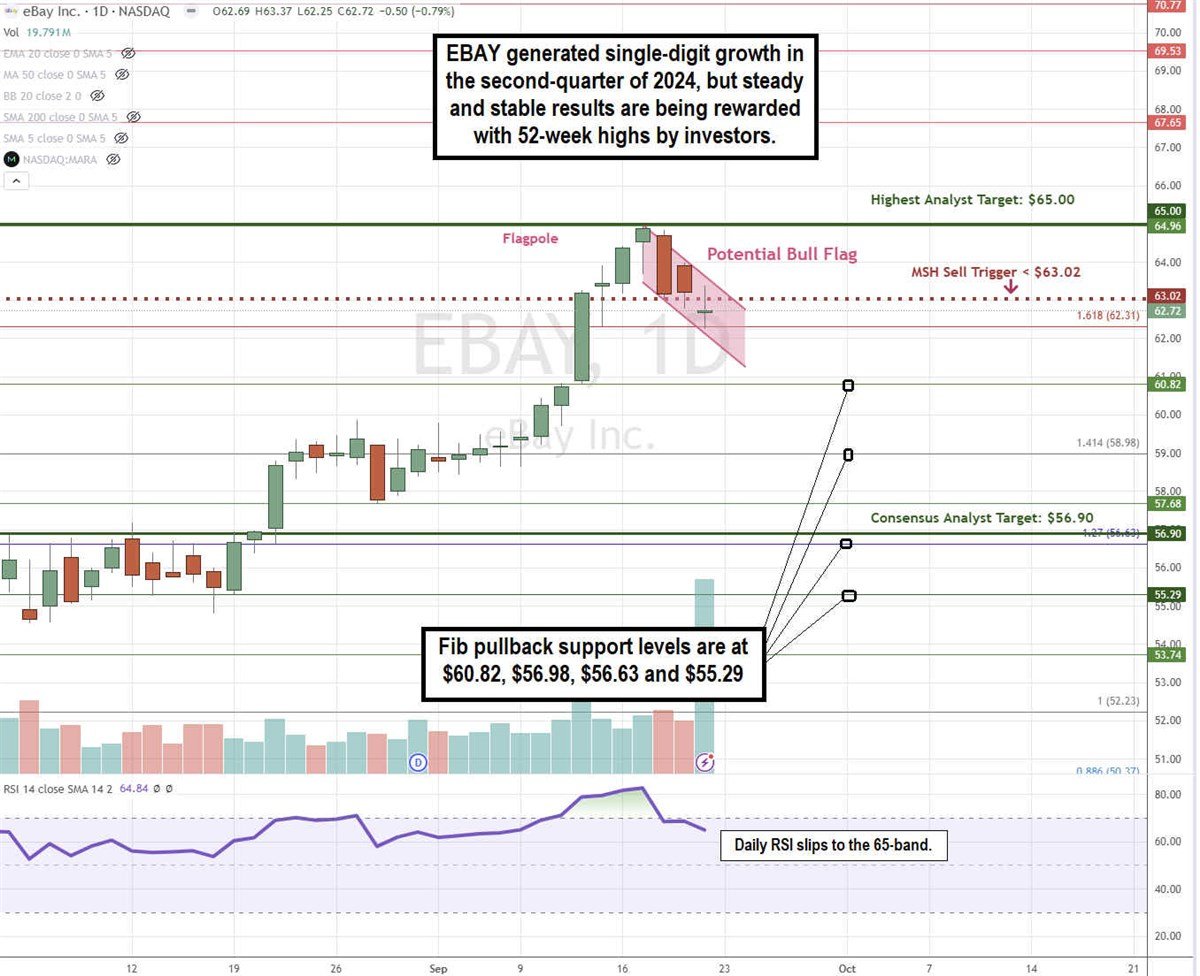

eBay’s projected Q3 2024 earnings remain promising, with expected revenues between $2.50 billion and $2.56 billion. The stock charts unveil a potential bull flag pattern, suggesting future upward momentum within the market.

Embracing volatility, eBay stock presents opportunities for strategic investment, with pullback support levels offering entry points for bullish investors aiming to capitalize on potential growth.

As eBay’s journey unfolds, its resilience and innovation continue to position it as a formidable player in the digital landscape.