Investing in a stock just before an earnings release can be akin to traversing a shaky bridge – the path ahead is uncertain, and steady nerves are necessary. With Ford Motor about to unveil its earnings data, my stance as a cautious investor is anything but bullish on Ford stock, given the unsettling sales figures already on the table.

Ford Motor, a titan in the automotive realm dealing in a gamut of vehicles from traditional to electric, boasts a decent dividend yield. However, the allure of bargain-priced Ford shares may seem beguiling at first glance, but it fails to paint the full picture of the company’s current predicament.

Steer Clear of the Value-and-Yield Quagmire with Ford Stock

When a stock appears inexpensive with a promising dividend yield, it’s a potent recipe for trapping unsuspecting investors in a morass of false promises. Ford’s non-GAAP trailing 12-month P/E ratio of 6.77x may appear appealing, as does the forward annual dividend yield of 7.05% surpassing the sector average. Yet, a cautionary note sounds; a plummet in the stock price can distort these seemingly reassuring metrics – as evidenced when F stock recently plunged from $14.50 to $11.

Mark Your Calendar for Ford’s Impending Earnings Reveal

Quarterly earnings disclosures hold the power to either catalyze a stock’s ascend to zenith or precipitous descent into the abyss. Despite the looming cloud of uncertainty, daring speculators might be tempted to dip their toes into Ford stock waters even before the company unveils its third-quarter 2024 financial results on October 28.

However, my stance tilts bearish due to a glaring reason – Ford’s sluggish vehicle sales growth in the third quarter of 2024, reflecting a meager 0.7% year-over-year increase. Contrast this with a robust 7.7% year-on-year growth in the same period last year, and it’s evident that Ford, alongside fellow Detroit-based automakers like Stellantis, is struggling to navigate the murky waters of sales amidst concerns over vehicle affordability.

Challenges in Ford’s Autonomous Driving Endeavors

Adding fuel to the fire, Ford’s decision to slash prices on its BlueCruise hands-free driving technology subscriptions rings alarm bells. The significant reduction from $75 to $50 monthly and $800 to $495 annually indicates waning demand for BlueCruise in an era where autonomous features reign supreme. Such moves hint at Ford falling behind rivals like Tesla in the self-driving technology race.

Analysts’ Verdict on Ford Stock

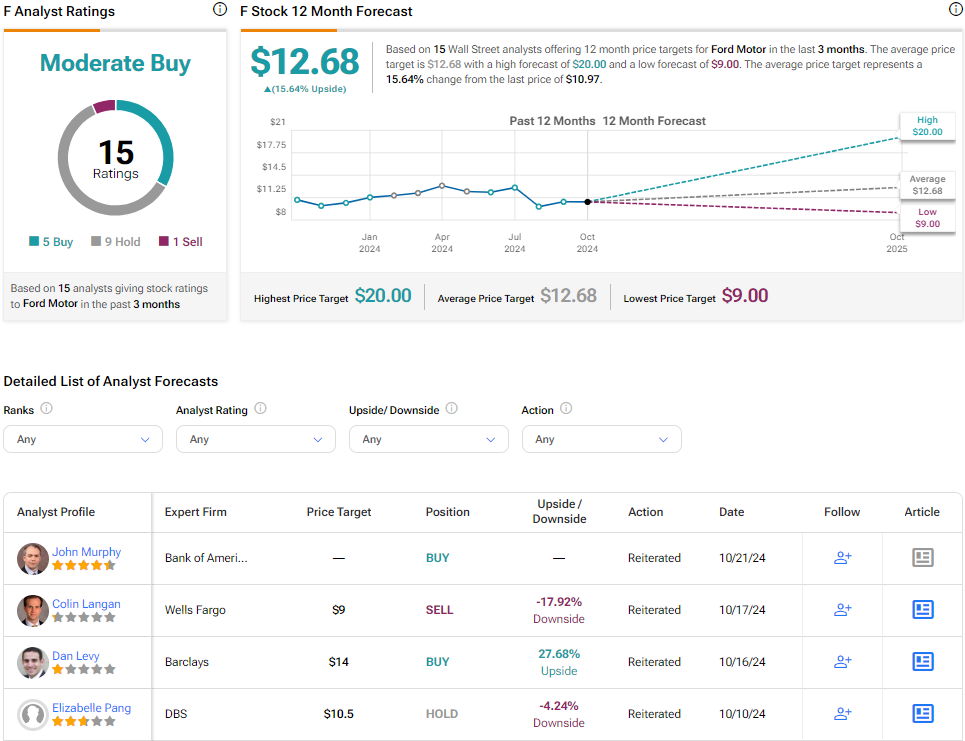

Analysts’ sentiment on F stock remains lukewarm, per TipRanks, with a Moderate Buy rating based on a mix of Buys, Holds, and Sells. The average price target of $12.68 suggests a modest upside potential of 15.64%, hinting at a cautious optimism in the market.

For those eyeing Ford stock, the most accurate analyst covering the stock over a one-year timeframe is Michael Ward of Benchmark Co., boasting an average return of 11.88% per rating and a 50% success rate.

Final Thoughts on Ford Stock

All signs point to a bumpy road ahead for Ford Motor stock. The lackluster sales growth, coupled with discounted BlueCruise subscriptions, paints a gloomy picture. As Ford gears up to unveil its third-quarter financial results, prudence suggests treading cautiously and avoiding the allure of what may well be a treacherous value-and-yield trap. Wait for the financial veil to be lifted before making any bold moves with Ford stock. In a market fraught with uncertainties, a cautious approach may be the safest bet.