When it comes to finding avenues for passive income, investors often venture into various financial instruments. Amid a sea of options like dividend stocks and real estate partnerships, exchange-traded funds (ETFs) stand out as a favorite due to their simplicity and reliability.

One prominent player in the realm of passive income is the JPMorgan Equity Premium Income ETF (NYSEMKT: JEPI). With its promise of a consistent monthly income flow, this ETF has captured the attention of income-oriented investors like myself, driving us to continually augment our stake in the fund.

Diving into JEPI’s Exceptional Income Generation

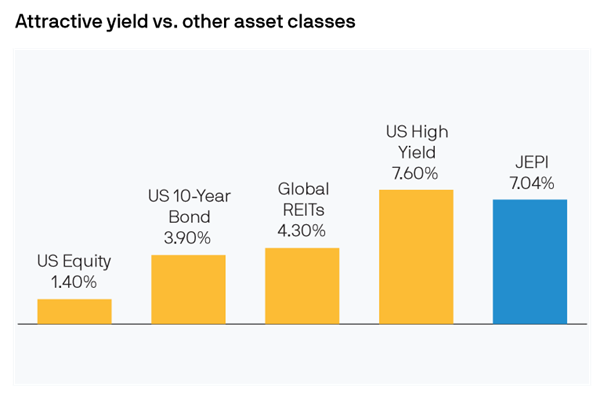

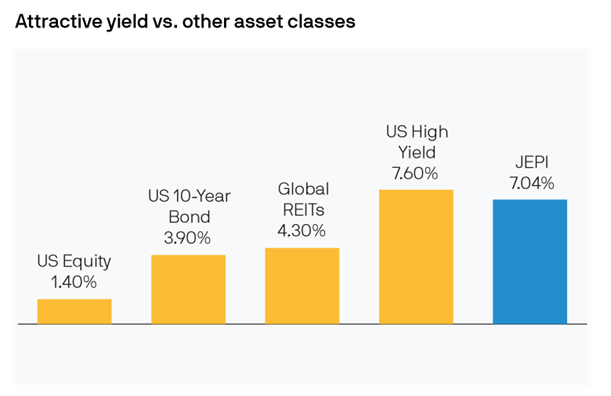

Functioning as an actively managed fund, the JPMorgan Equity Premium Income ETF is designed to deliver monthly income alongside equity market exposure, all while mitigating the volatility inherent in the broader stock market landscape. Over the past year, it has astounded investors by outperforming other asset classes focused on generating income.

Image source: JPMorgan Asset Management.

Data reveals that JEPI has produced income almost on par with the average U.S. high-yield bond in the last 30 days. Notably, its yield over the past 12 months stands at a remarkable 8.5%, eclipsing the returns of a 10-year treasury or a real estate investment trust (REIT) by more than twofold.

Investors receive monthly distribution payments from the fund, although these payments can exhibit considerable variance month by month. Yet, the overall annual yield remains robust, making it an attractive proposition since the fund’s inception.

Despite being actively managed, the ETF boasts a modest expense ratio of 0.35%, enabling investors to retain a larger share of the income generated on their behalf.

Decoding JEPI’s Premium Income Generation Strategy

The JPMorgan Equity Premium ETF adopts a dual-pronged approach to generate income for its investors:

- A defensive equity portfolio: The fund managers employ a meticulous bottom-up research process to cherry-pick high-quality stocks based on a proprietary risk-adjusted ranking system, many of which pay dividends.

- A disciplined options overlay strategy: The fund’s managers engage in writing out-of-the-money call options on the S&P 500 Index to generate monthly distributable income.

The defensive equity portfolio of the fund currently spans over 100 holdings, with notable positions held by companies like:

- Progressive: This insurance behemoth accounts for 1.7% of the fund’s net assets and offers a dividend yield of 0.5%.

- Trane Technologies: The HVAC manufacturer holds a 1.7% share in the fund’s assets, presenting a dividend yield of 1.1%.

- Microsoft Corporation: The tech giant occupies 1.7% of the portfolio and provides a dividend yield of 0.7%.

- Amazon…

The Rise of JPMorgan Equity Premium Income ETF

The financial world is abuzz with the impressive performance of the JPMorgan Equity Premium Income ETF. This hidden gem has quietly secured a position as a standout income generator in the realm of exchange-traded funds. Let’s delve into what makes this ETF a compelling choice for income investors.

The Power of Diversification

One of the key strengths of the JPMorgan Equity Premium Income ETF lies in its diversified portfolio. With holdings in top players like Amazon and Meta Platforms, the fund strikes a balance between high-yield dividend stocks and out-of-the-money call options on the S&P 500. This unique blend not only provides investors with steady dividend income but also offers potential for price appreciation.

Managing Volatility with Finesse

Volatility is the name of the game in the world of investments, but the JPMorgan Equity Premium Income ETF knows how to play it smart. By strategically writing call options on the S&P 500, the fund generates premium income that cushions against market turbulence. This approach not only boosts income for investors but also helps to mitigate the inherent volatility of equities.

An Exceptional Source of Passive Income

Investors seeking quality passive income need not look further than the JPMorgan Equity Premium Income ETF. Boasting a track record of delivering superior income returns through monthly cash distributions, this ETF has outperformed many income-focused investments in the past year. The ability to offer attractive yields while reducing risk underscores its appeal as a reliable source of passive income.

Is it Time to Invest in JPMorgan Equity Premium Income ETF?

Before taking the plunge into the JPMorgan Equity Premium Income ETF, it’s essential to weigh your options carefully. While this ETF has gained traction for its income-generating prowess, other stock picks recommended by renowned analysts may offer a potential for even greater returns.

If you’re on the lookout for a blueprint for investment success, services like Stock Advisor can provide valuable insights and guidance on building a robust portfolio. With a proven track record of outperforming the S&P 500, these services offer a treasure trove of resources for investors seeking to navigate the complex world of finance.