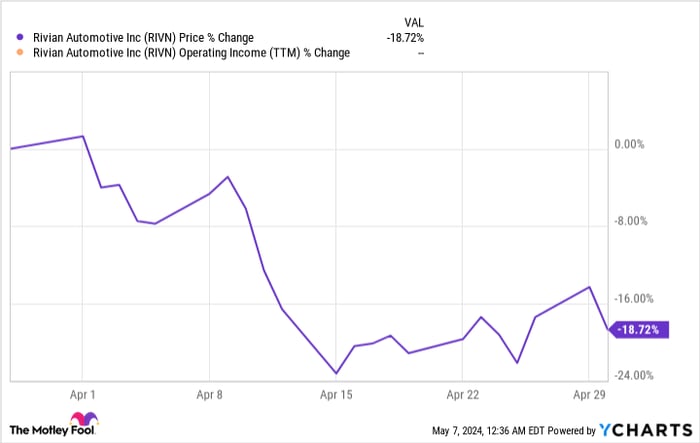

Investors in electric-vehicle (EV) darling Rivian (NASDAQ: RIVN) found themselves clutching their seats as the stock took a harrowing 19% plunge in April, mirroring a turbulent month for the broader EV sector.

Rivian Rides the Downward Spiral

The descent began as Rivian reported delivery figures matching forecasts and maintained its production outlook for 57,000 vehicles this year. Despite delivering 13,588 vehicles in Q1, the absence of an upward guidance revision left investors yearning for more.

Compounding Rivian’s misery, EV frontrunner Tesla disclosed a 9% earnings dip in its quarterly report, signaling sector-wide challenges.

The company’s fortunes hit rock bottom in the second week of April when Ford Motor slashed prices on its F-150 Lightning EV, intensifying rivalry with Rivian in the electric pickup space.

Furthermore, a resurgence in inflation, as indicated by the Consumer Price Index in mid-April, dashed hopes of an interest rate cut by the Federal Reserve, dampening prospects for luxury vehicle demand and adding to Rivian’s woes.

To cap off a tumultuous month, Rivian announced a 1% reduction in its workforce on April 17 as part of a cost-cutting exercise to address its substantial losses.

Image source: Rivian.

Into the Future for Rivian

As dusk settles on Tuesday, investors eagerly await Rivian’s Q1 earnings report for any glimmer of hope amidst the gloom.

Analysts anticipate a 76% revenue surge to $1.16 billion, paired with a loss per share of $1.17, as compared to $1.25 a year earlier. However, surpassing estimates may not suffice to steer the stock northwards, with shareholders craving signs of progress toward profitability.

Should One Plunge into Rivian?

Before plunging into Rivian stock, it’s wise to heed caution and remember that even the prominent Motley Fool Stock Advisor team chose not to include Rivian Automotive in its list of the 10 best stocks. Tesla’s humble beginnings were no barrier to its stellar ascent, reminding us that fortunes can change seemingly overnight in the stock market.

Stock Advisor offers a roadmap for investors seeking triumph in the tumultuous market seas, showcasing the potential for immense returns beyond the benchmark S&P 500.

Jeremy Bowman is unaffiliated with the stocks mentioned. The article’s source maintains positions in and endorses Tesla, upholding a stringent disclosure policy.