Electric vehicle (EV) giants such as Tesla, Rivian, and QuantumScape showcased a remarkable surge in their stock prices on Friday, with gains of 4.3%, 8.8%, and 4.3%, respectively, as of 2:28 p.m. ET. The driving force behind this unexpected rally was not any company-specific news but rather Federal Reserve Chair Jay Powell’s dovish remarks at the Jackson Hole conference.

The Game-Changing Declaration

In a bold assertion during his speech, Powell stated, “The time has come for policy to adjust.” This strong statement, hinting at an imminent rate cut in September, resonated profoundly with investors. The implications of lower interest rates are particularly promising for companies that have endured the brunt of rising rates over the past couple of years, with EV stocks bearing a significant impact.

Powell’s confidence in foreseeing a “soft landing” rather than a recession due to anchored inflation expectations provided a beacon of hope for investors in EV companies, hinting at improved margins and easier access to capital.

The Impact of Interest Rates on EV Companies

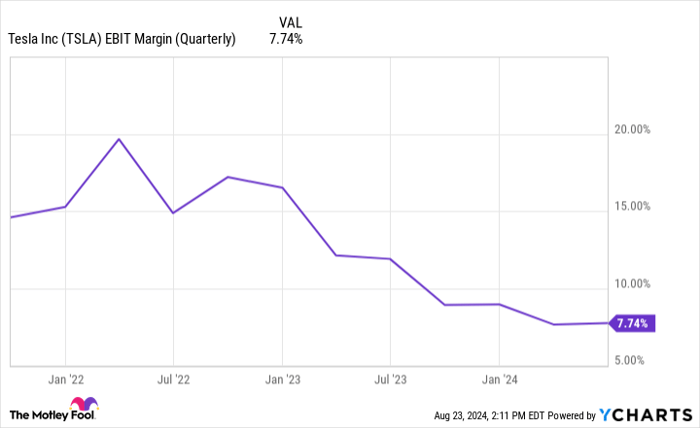

The adverse effects of high interest rates on EV firms manifest in various ways. Firstly, elevated rates deter consumers from making substantial purchases such as EVs, leading to decreased demand and price cuts by companies to stimulate sales. This scenario squeezes profit margins, as evident in the case of industry leader Tesla.

Secondly, high interest rates raise the cost of capital and hurdle rates, presenting a formidable challenge for low-profit entities like Rivian and QuantumScape. For loss-making companies, the decreased present value of future earnings coupled with pricier capital raise the stakes even higher.

Thus, the anticipation of a rate cut offers a much-needed respite to EV stocks, easing the burden on both margins and capital costs.

Image source: Getty Images.

Looming Challenges Despite Lower Rates

While a rate cut offers considerable support, it is crucial to recognize the inherent challenges of the auto industry. Auto production is capital intensive, cyclical, and characterized by fierce competition and slim margins, driving mature players to trade at subdued P/E multiples.

In an ever-evolving landscape, Tesla, Rivian, and QuantumScape face distinct hurdles. Tesla’s push into robotaxis poses uncertainties, Rivian grapples with operational losses despite high-profile partnerships, and QuantumScape navigates uncharted waters as it strives to monetize solid-state battery technology.

Despite Volkswagen’s cash infusion and technology collaborations with Rivian and QuantumScape, the complex dynamics of the auto industry underscore the intricacies of investing in this sector, even amidst lower interest rates.

Considerations for Tesla Investors

Though Tesla stands at the forefront of EV innovation, potential investors must weigh the risks. The tumultuous terrain of the auto industry, coupled with the evolving EV landscape, necessitates a calculated approach to investment decisions.

As the market surges with new opportunities, analytical tools like the Stock Advisor can provide valuable insights and guidance in navigating the complexities of the automotive sector.

John Mackey, the former CEO of Whole Foods Market, a subsidiary of Amazon, sits on The Motley Fool’s board of directors. The Motley Fool holds positions in Amazon, Tesla, and Volkswagen Ag.