Shares of the Invesco QQQ Trust (NASDAQ: QQQ) were among the big winners on the stock market last year. The ETF that tracks the Nasdaq 100 soared 54% last year, according to data from S&P Global Market Intelligence.

A confluence of factors propelled the tech-heavy index fund, including the fervor surrounding new generative AI technologies, undervalued tech stocks at the outset of 2023, and corporate cost-cutting measures which bolstered profits.

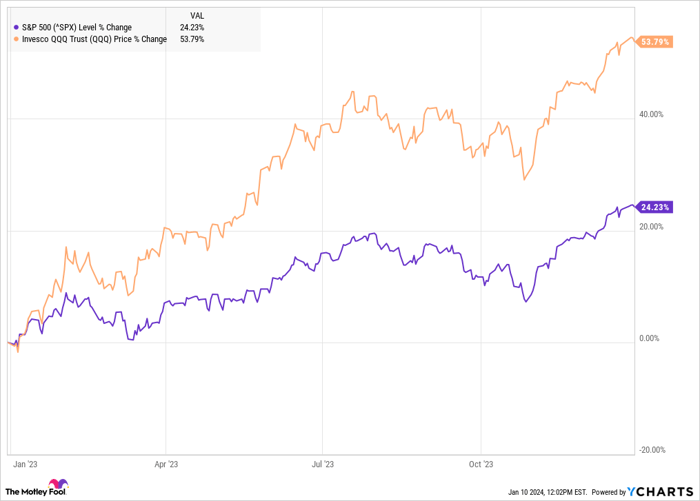

The chart below illustrates the ETF’s performance over the course of the year.

The QQQ’s gains trended with the S&P 500 throughout the year but outpaced it, reflecting the AI enthusiasm and the low valuations of several major tech stocks early in the year.

The Tech Surge: Unpacking the Growth in 2023

The Invesco QQQ Trust comprises the 100 largest non-financial Nasdaq stocks, with the index currently dominated by the Magnificent Seven stocks.

All of these stocks achieved significant gains, underscoring the trends that propelled the QQQ to substantial growth.

For instance, Nvidia (NASDAQ: NVDA) shares more than tripled as the company emerged as the major benefactor of the demand for AI chips, leading to a surge in revenue and profit margins. Meta Platforms (NASDAQ: META) stock also tripled amid the execution of its “Year of Efficiency,” marked by cost reductions, heightened margins, and a rebound in advertising demand.

Tesla (NASDAQ: TSLA) stock doubled even as profits dipped in its latest quarter, buoyed by anticipation for its AI and autonomous vehicle technology. Additionally, big tech stocks like Microsoft, Apple, Alphabet, and Amazon rose on the back of expanding profit margins, AI advancements, and the perception that the economy would evade a recession.

Image source: Getty Images.

Charting the Future: Prospects for the Nasdaq QQQ ETF

The Nasdaq 100 currently trades at a price-to-earnings ratio of 29.1, significantly higher than its level a year prior at 23.5, and even exceeding the S&P 500’s at 21.6.

This valuation mirrors the elevated expectations embedded in tech stocks due to the AI momentum. However, profits are expected to climb for major tech stocks this year, and the AI momentum should persist as the investments made over the past year begin to yield results.

While another 54% gain from the QQQ ETF may not be realistic, it still appears well-positioned for additional growth provided the economy steers clear of a recession.

Before contemplating an investment in the Invesco QQQ Trust, it’s prudent to consider that the Motley Fool Stock Advisor analyst team recently identified what they believe are the 10 best stocks for investors to buy now, none of which included the Invesco QQQ Trust. Predicted to yield monumental returns in the coming years, Stock Advisor offers investors a straightforward roadmap to success, including portfolio construction guidance, analyst updates, and two new stock picks each month.

The Stock Advisor service has outperformed the S&P 500 thrice over since 2002*.

*Stock Advisor returns as of January 8, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jeremy Bowman has positions in Amazon and Meta Platforms. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has a disclosure policy.