As the dust settles on the recent interest rate cut by the U.S. Federal Reserve, the stock market is witnessing a resounding surge to unprecedented levels.

The Past as a Guide to the Future

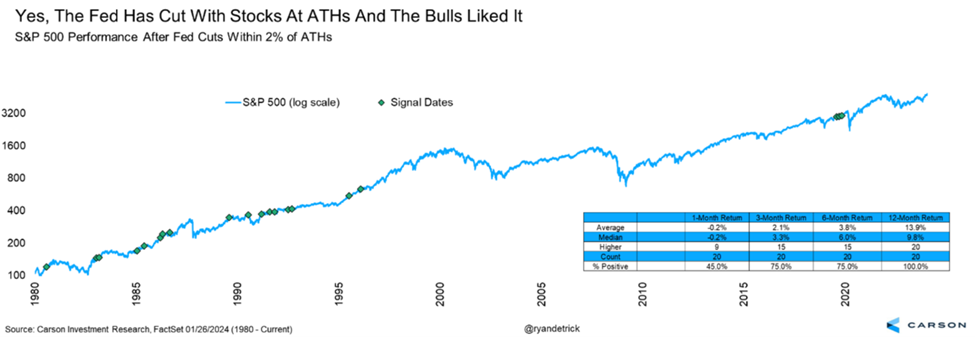

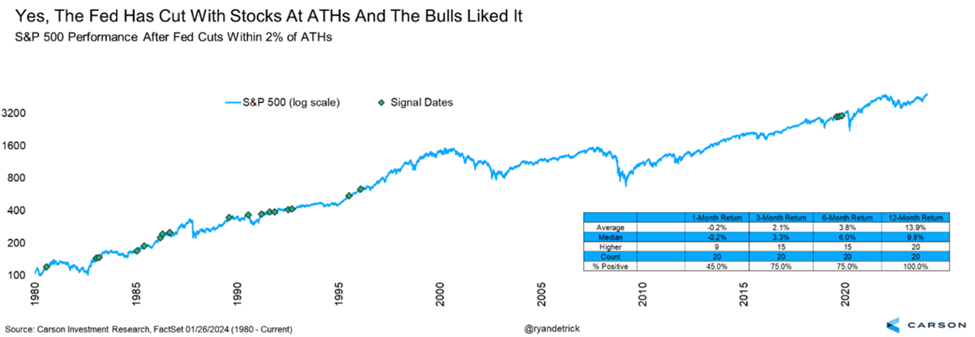

History serves as a road map for what may lie ahead following the commencement of a rate-cutting cycle by the Federal Reserve with stocks at record highs. This scenario, repeating roughly 20 times since 1980, has consistently led to stock market peaks over the subsequent year, yielding an average return of close to 15%.

When the Fed implements rate cuts in such an environment, a common outcome is a thriving market environment over the ensuing year. This historical trend underlines an optimistic outlook for stock performance in the coming months.

Current Economic Landscape

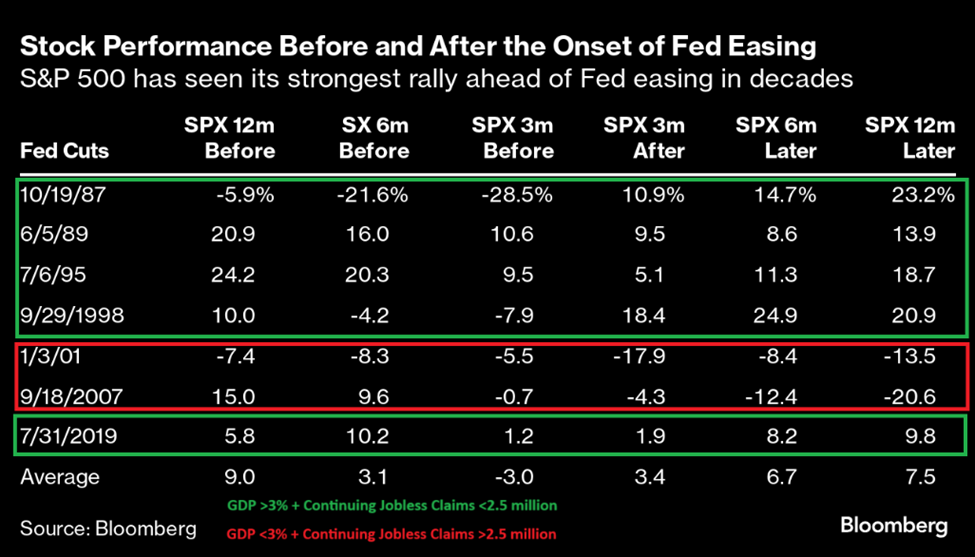

Noteworthy is the fact that the recent rate cut by the Fed coincides with a robust economic setting, with real-time GDP estimates indicating a growth rate of approximately 3% and jobless claims hovering around 1.8 million. This juxtaposition of a rate cut amidst economic growth and low unemployment has precedents in history. Instances in 1987, 1989, 1995, 1998, and 2019 bear resemblance to the present conditions and have seen significant stock market upturns, averaging a 17% return over the following year.

While certainty does not exist in the ever-fluctuating financial realm, the weight of historical evidence indicates a high probability for stocks to rake in substantial market gains in the foreseeable future.

The Final Say on Interest Rate Cuts and Stock Market Surges

The recent rate cut by the Federal Reserve, coinciding with the stock market hovering near record highs, the economy maintaining robust ~3% growth, and unemployment staying at historically low levels, constitutes a potent blend. Based on past occurrences, this cocktail of factors appears poised to act as a catalyst for a substantial surge in stock prices over the upcoming year.

Tech Stocks Set to Lead the Charge

When it comes to market rallies, certain stocks tend to outshine the rest. In the current scenario, there is a strong belief that tech stocks, particularly those in the realm of Artificial Intelligence (AI), are primed to take the helm. This confidence is rooted in the parallels drawn between the current phase of interest rate cuts and the period of 1998-1999, a time when tech stocks experienced a significant upswing.

As history recalls, in the late 1990s, the stock market was riding high on the emergence of revolutionary internet technologies. Companies were heavily investing in building new internet infrastructure and pioneering innovative products and services, propelling internet stocks to soaring heights on Wall Street.

A Paralleled Scenario: 1998/99 vs. Today

Similar to the late 1990s, tech stocks, especially those in the AI domain, have captured the limelight in recent years. With companies pouring resources into developing AI infrastructure and cutting-edge solutions, AI stocks have witnessed remarkable growth on the stock market.

As the economy begins to show signs of a slowdown – albeit minor, but sufficient to cause concern among investors, induce market fluctuations, and prompt the Federal Reserve to implement interest rate cuts – the stage is set for a potential resurgence. These rate reductions are anticipated to reinspire economic stability, and in turn, fuel the ongoing boom in the AI sector, propelling AI stocks to new heights into the years 2025 and 2026.

Revisiting the late 1990s, when the Nasdaq 100 experienced an extraordinary surge of over 300% in value from late 1998 to early 2000, offers a hint at the potential magnitude of the forthcoming market dynamics in the AI sector.

Worry not, for those with the foresight to invest in the right AI stocks, the journey could prove immensely fruitful in the coming 12 to 24 months.

Yours Truly,

Luke Lango

Editor, Hypergrowth Investing