The IBES data by Refinitiv data, meaning the “This Week in Earnings” or the “Earnings Scorecard” reports were never sent out to subscribers last week, which may have been by design, since almost no companies reported earnings last week, hence, this blog is using the 12/22/23 data and carrying it forward one week to 12/29/23 for readers to peruse.

(Funny, the Refinitiv invoice for providing this data shows up on the first day of every January, April, July, and October at 7:30 am in my email inbox, just like clockwork. At least a few weekends a year, the sending of the actual subscription isn’t as big a priority as the invoice appears to be.)

Anyway, hate to start 2024 with a gripe.

S&P 500 Earnings Data

- The forward 4-quarter estimate (FFQE) ended 2023 at $234.60, versus the $235.77 from mid-Dec ’23;

- The PE on the forward estimate is 20.3x versus the 20x from mid-December ’23;

- The S&P 500 earnings yield (EY) has settled the last three weeks at 5% or lower. With the S&P 500 rally from September 29th, where the EY settled at 5.43%, the earnings yield has fallen 10 of the last 14 weeks;

- The 3rd quarter, 2023 EPS estimate ended at $58.40 versus the 9/29/23 value of $55.92, with actual growth of +7.5% versus the +1.9% growth expected on 9/29/23;

- The 4th quarter 21023 EPS estimate has fallen from $58.14 to $54.69 since 9/29/23, while the growth rate has fallen from an expected +12.7% to an expected +5.2%;

- To be frank with readers, that’s a sharp decline in the coming earnings quarter’s expected growth BUT, most earnings data services aren’t telling you that the jump to +7.5% from +1.9% in Q3 “actual” EPS is also a bigger-than-expected “upside surprise” for this past quarter;

Just one thought on the earnings yield and expected Q4 ’23 earnings: a stronger-than-expected 4th quarter ’23 EPS, with big “upside surprises” likely means a decent US economy, (depending on the sector), and could have implications for Fed easing in March ’24.

Here’s the actual “upside surprise” for S&P 500 EPS the last 8 quarters:

- Q4 ’23: unknown – Q4 ’23 earnings start January 12th, 2024;

- Q3 ’23: +7% (would still like to see the year-end 12/29/23 report, but 7% is roughly accurate for Q3);

- Q2 ’23: +7.9%

- Q1 ’23: +6.8%

- Q4 ’22: 1%

- Q3 ’22: 3.4%

- Q2 ’22: +5.5%

- Q1 ’22: 7%

Note how 2022’s upside surprise became less and less robust as we moved through the year and the Fed raised interest rates.

Economic Data

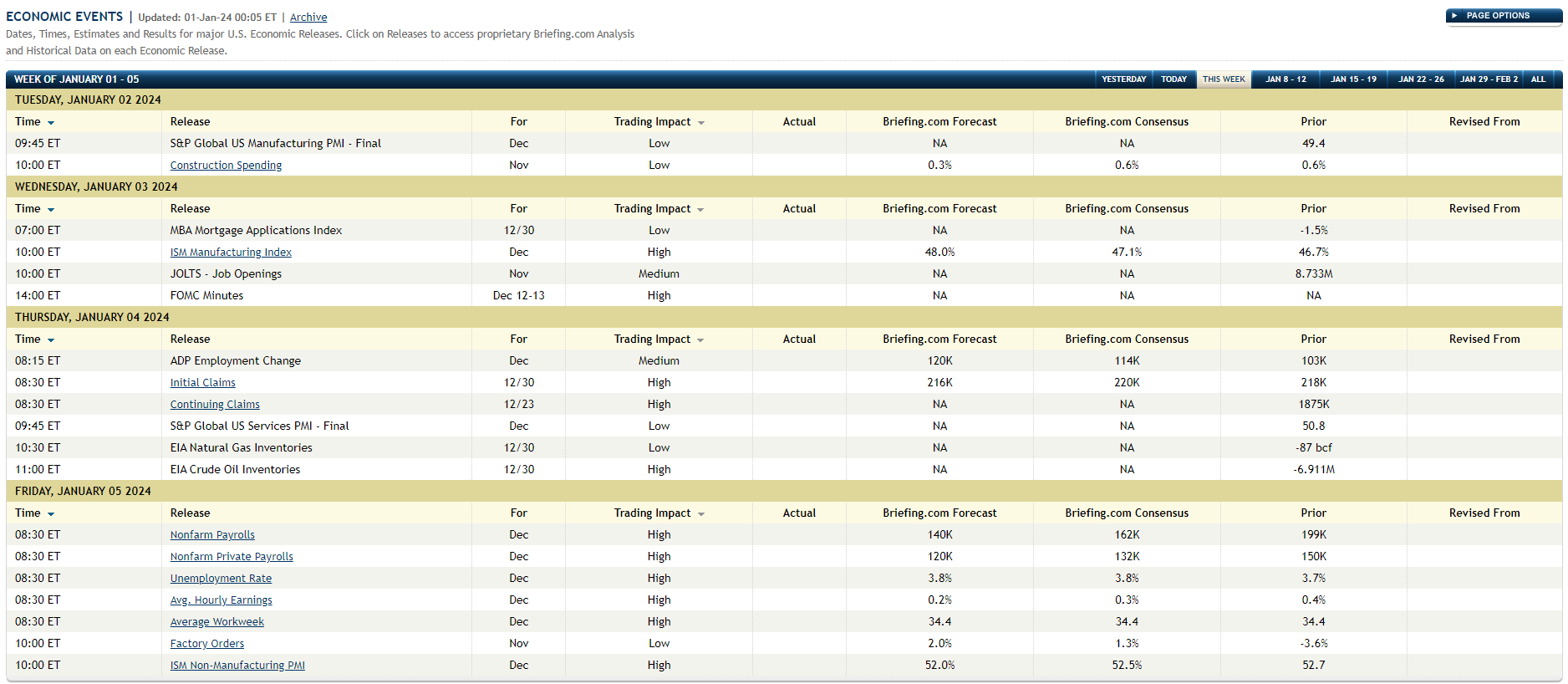

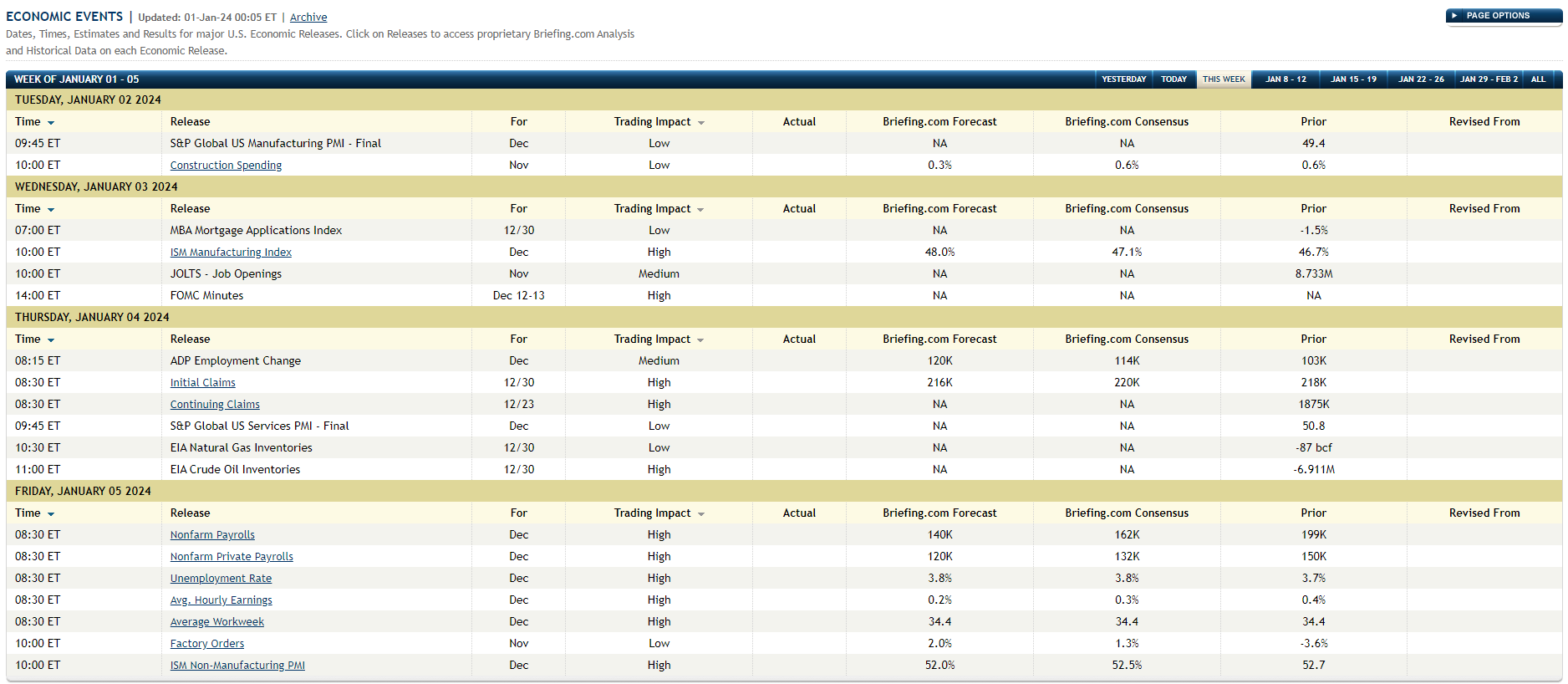

The first week of the new year will be all about employment and jobs data.

- Wednesday, Jan 3 ’24; JOLTS update, which has been showing fewer jobs open as we moved into the back half of ’23;

- Thursday, Jan 4 ’24: we see both the ADP and jobless claims data.

- Friday, Jan 5 ’24: we see the December ’23 nonfarm payroll report with Briefing.com expecting 162,000 in net, new, jobs created in the month, and private payroll growth of 132,000.

When I started in the business in the early 1990s, and weren’t around back then, so younger readers and investors get a wider perspective on US jobs data in the last 10 – 20 years, thanks to the newer reports.

The problem is or was the jobs data, like the report, is subject to such material revisions in following months, you can be right on the over / under and the market, and yet you might not find that out for a few months, and the market reaction (stocks and bonds) will typically follow the headline numbers, while the revisions get far less discussion.

still has me a little worried in the sense that it isn’t weakening much.

The beauty of the jobless claims release is that it’s frequent (every Thursday at 7:30 am central) and more importantly, timely, (last week’s increase was from an expected 207k to 218k for the week of December 23, or one week behind) which is good as you can get in terms of economic data.

The fact is US economic data has remained stubbornly “healthy” and hasn’t shown the weakening expected with such draconian rate hikes.

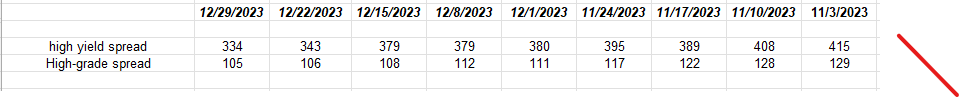

One Comment on High-Yield Credit

This spreadsheet pasted above is the trend in high-yield and high-grade (investment-grade credit spreads) from early November ’23. (The source of the spread data is Bespoke.)

That’s an 80 basis point tightening in high-yield credit spreads (below-investment-grade bonds) in the last 8 weeks. The high-grade (investment-grade credit bonds) spreads tightened far less, but high-grade bonds are more “duration-sensitive” than credit-sensitive anyway.

Anyway, for someone who started out in the business as a credit geek, looking at balance sheets, this high-yield credit spread tightening is an unambiguous positive for the equity bulls. (Just putting it out there.)

Conclusion

Walgreens (WBA) reports before the bell on Thursday, January 4th, 2024, and with the appointment of the new CEO, this quarter could be a real “kitchen sink” in terms of the dividend and guidance.

It’s hard to say if the rally in WBA the last two months was a “dash to laggards” like the rest of the market saw, meaning laggards rose sharply into year-end 2023, or if Tim Wentworth, the new CEO is being given an early vote of confidence by shareholders.

The jobs data is meaningful this coming week: it makes me uncomfortable to see all the bullishness around the stock and bond markets, so early in ’24. I don’t think inflation will be an issue, but if the US economy remains reasonably robust, particularly the jobs market, it might result in Jay Powell dragging his feet even more when it comes to the expected fed rate cuts since the Fed remains unusually tight with US monetary policy given the 5.25% fed funds rate and the 2.5% “inflation expectations” data being published.

Anyway, thank you to readers for reading, and for the thoughtful and balanced comments and the good discussions had with readers – particularly Seeking Alpha readers – over the course of the year. I always enjoy and learn from broader, thoughtful commentary by readers.

***

Remember, none of this is advice or a recommendation, and past performance is no guarantee or suggestion of future results. Investing can involve the loss of principal. All S&P 500 earnings data is sourced from IBES data by Refinitiv, when they care to send it in a timely fashion.

None of this information may be updated, and if updated, may not be done so in a timely fashion. Capital markets can change quickly, for both the good and bad. Readers should gauge your own comfort level with portfolio volatility and adjust that portfolio accordingly.

As always, thanks for reading.