The trillion-dollar club represents the epitome of corporate success, an exclusive echelon coveted by all firms. Investors pursue the next potential entrant into this elite assembly, cognizant of the immense wealth generated by these companies. Consider the case of Nvidia, an AI chip luminary, which began 2023 with a $350 billion market cap and has since burgeoned to over $1.2 trillion, an astronomical ascent indeed!

Within the buoyant milieu of the AI revolution, the quest for future trillion-dollar entities comes as no surprise. Increasingly, the AI sector may create more candidates for such an honor, such as a key competitor of Nvidia.

Prospects of Advanced Micro Devices

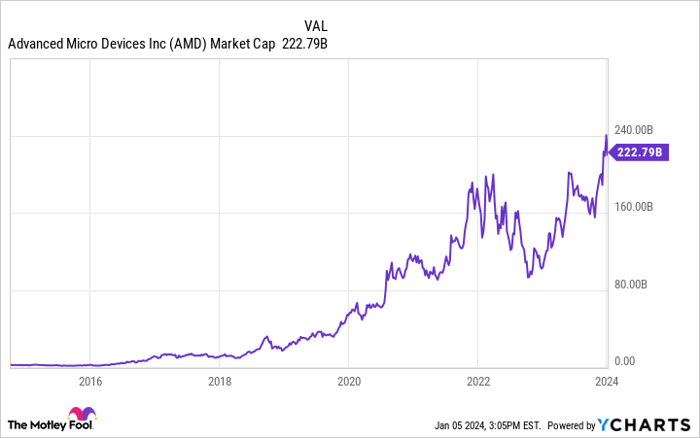

Given the meteoric rise of AI computing, Advanced Micro Devices (AMD) stands poised to scale new heights. The aegis of CEO Lisa Su has steered AMD from a mere $2.4 billion market cap in October 2014 to an astounding $223 billion today, marking a hundredfold surge during her stewardship.

AMD’s remarkable transformation stemmed from a strategic shift under Su’s leadership. Diversifying away from PCs, AMD broadened into high-end domains such as gaming, embedded chips, and data center processors. Simultaneously, Su capitalized on the 2017 transition to FinFet transistors to narrow the gap with industry behemoth Intel in process technology.

Whereas Intel once dominated the processor market, the advent of advanced chipmaking technologies prompted a reversal of fortunes. AMD’s foundry partner, Taiwan Semiconductor Manufacturing (TSM), forayed ahead of Intel in leading-edge chip production, catapulting AMD to the vanguard of power and performance and precipitating a seismic shift in market dynamics.

Can AMD Carve a Niche in AI?

Can AMD replicate its triumph in PC processors within the realm of AI accelerators? The introduction of AMD’s MI300 line of AI accelerators in June 2023 appears as a resolute stride in this pursuit. Boasting a unique “chiplet” architecture comprising 12 chiplets, the MI300 harnesses 153 billion transistors and sustains a capacity of 192 gigabytes of HBM3 memory, eclipsing Nvidia’s H100 on various facets.

With such engrossing specs, AMD seems poised to captivate AI customers, particularly those with memory-intensive applications. Little wonder that Su anticipates a revenue of at least $2 billion from the MI300 accelerators in 2024, despite its recent production ramp-up.

Can AMD compete with Nvidia in AI? Image source: AMD.

Nvidia’s Ongoing Supremacy

Despite the MI300’s differential advantages over the H100, AMD is unlikely to attain parity with Nvidia in the near term. Notably, the MI300 lacks the transformative engine of the H100, precluding the former from tripling the latter’s performance, a factor pertinent for expeditious training of large language models that could retain customers with the H100 for critical applications.

Nvidia’s strategic progression is exemplified by the impending launch of the H200 in the second quarter, and an imminent transition to a new architecture, the B100, by next fall/winter. Moreover, the recent acceleration in Nvidia’s cadence for new AI chip architectures underscores a formidable trajectory. In contrast, AMD’s nascent MI300 release places it in an arduous race to close the gap, further complicated by Nvidia’s partnership with the resilient TSM, a formidable bulwark against the vicissitudes encountered by Intel.

Additionally, Nvidia’s longstanding development of the CUDA software stack since 2006 and its establishment of a robust network effect among developers endow it with an entrenched advantage. Although AMD endeavors to fashion its own quasi-open-source software stack, termed RocM, its 15-year lag behind Nvidia poses an arduous endeavor in the pursuit of equivalence.

Future Trajectory to a Trillion-Dollar Valuation

Irrespective of AMD’s status as a secondary option for AI chips, the burgeoning AI market portends a conceivable avenue to achieve a trillion-dollar valuation. Su’s ambitious revision, elevating the AI chip market projection from $150 billion to $400 billion by 2027, augurs positively for AMD’s prospects.

Moreover, the prospective ascendancy in the AI chip market, predicated on AMD’s robust position in PCs, bodes well for surging revenues. Even a marginal 10% share of the $400 billion AI chip market could propel AMD’s revenue to approximately $65 billion by 2027. Assuming a 30% net income margin, this trajectory could culminate in earnings of $20 billion, potentially catalyzing a $1 trillion market cap by that time.

While this valuation may appear ambitious, the inexorable expansion of the AI chip market renders it a realistic speculation. Therefore, as the AI domain unfolds with unprecedented vigor, AMD’s ascendency to the trillion-dollar pedestal remains a tangible proposition.

The Future of Advanced Micro Devices: A Beacon for Investors

Investors in Advanced Micro Devices (AMD) have witnessed a staggering climb in the stock’s value in recent years. The company has been gaining traction in multiple sectors, most notably in the sphere of artificial intelligence (AI) chips. The question on every investor’s mind is, can this remarkable trajectory be sustained?

The Meteoric Rise of AMD

AMD has emerged from the shadows of the tech industry, challenging the dominance of companies like Intel and Nvidia. Its stock value has soared, dwarfing previous expectations and leaving industry analysts in awe. The potential for expansion into the AI chip market has fueled speculation about the company’s future.

Envisioning a $1 Trillion Market Cap

Industry experts foresee a bright future for AMD, bolstered by the belief that the company could capture a significant portion of the AI chip market. If these predictions materialize, the company’s market cap could skyrocket well beyond the $1 trillion mark by the year 2030. For investors, this presents an enticing opportunity that is difficult to ignore.

Investment Considerations

As enticing as the prospects may appear, it is essential for investors to deliberate before diving headfirst into AMD. While optimism is high, there are competing perspectives on whether AMD is the best avenue for investment. The Motley Fool Stock Advisor analyst team, renowned for its insightful stock picks, has chosen to exclude AMD from its top 10 recommended stocks. The divergent perspectives in the market only add to the intrigue surrounding AMD as an investment option. It remains to be seen how the narrative develops in the coming years.

The Path Forward

As investors ponder the future of AMD, the company stands as a symbol of resilience and ambition. Its remarkable ascent has reshaped the dynamics of the tech industry, offering an alternative narrative to the traditional titans. The road ahead may be fraught with challenges, but for those willing to take the leap, the potential rewards are as tantalizing as ever.

Billy Duberstein has positions in Taiwan Semiconductor Manufacturing. His clients may own shares of the companies mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.