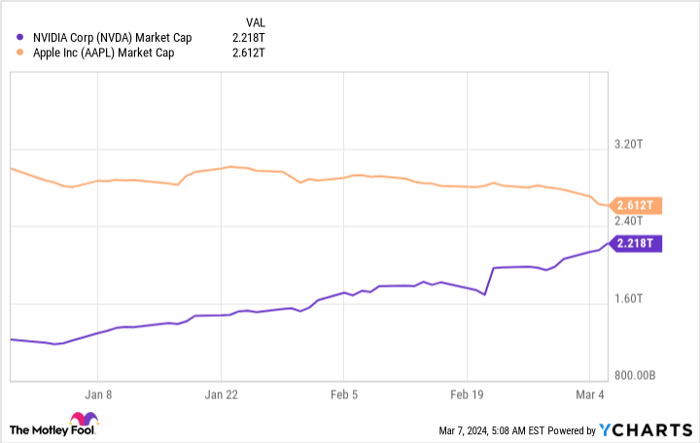

Nvidia (NASDAQ: NVDA) has been on a meteoric rise over the past year, propelling its market cap to $2.22 trillion and securing a spot as one of the world’s largest companies, trailing just behind Apple (NASDAQ: AAPL), which boasts a market cap of $2.61 trillion.

The contrasting stock market performances of these tech behemoths in 2024 have brought Nvidia tantalizingly close to Apple’s market cap. While Nvidia’s stock has soared by 79% this year, Apple’s shares have taken a 12% dip.

NVDA Market Cap data by YCharts.

But the question on investors’ minds is whether Nvidia can maintain its trajectory and surpass Apple’s market cap by next year.

The Growth Trajectory: Nvidia vs. Apple

Nvidia’s exponential market cap growth is fueled by its domination in the rapidly expanding artificial intelligence (AI) chip market. Projections indicate that the AI chip sector is poised to grow at a staggering 38% annually, with an estimated $207 billion in annual revenue by the end of the decade.

In fiscal 2024, Nvidia witnessed a remarkable 126% surge in revenue to $60.9 billion, driven by its stronghold in the AI data center graphics processing unit (GPU) segment, where it commands a staggering 98% market share, as per Wells Fargo. Enjoying robust margins from AI GPUs priced at tens of thousands of dollars, Nvidia recorded a phenomenal 288% leap in earnings per share to $12.96 in fiscal 2024.

In contrast, Apple’s primary revenue driver remains the smartphone market, particularly the iPhone, contributing 58% of its total revenue in the first quarter of fiscal 2024. However, Apple’s revenue growth has been modest, with a mere 2% uptick year-over-year to $119.6 billion in the quarter. Despite a 16% rise in earnings per share to $2.18, Apple witnessed varied performance across its product lines, with stagnant MacBook sales, declining tablet sales, and a marginal uptick in iPhone revenue.

An analysis of the end markets served by Apple underscores the disparity in growth rates compared to Nvidia. With the smartphone market slated for a meager 2.8% growth in 2024 and tablet sales on the decline, Apple contends with multiple competitors in mature markets, limiting its growth prospects.

Furthermore, Apple’s market presence is more fragmented, with a smartphone market share of 20.1% in 2023, placing it behind Samsung. In the PC market, Apple held a modest 8.5% share, illustrating Nvidia’s dominance in its key markets.

Analyst Projections and Market Sentiment

As per estimates, Nvidia’s revenue is forecasted to surge to nearly $131 billion in fiscal 2026, aligning with the majority of calendar 2025. Trading at 35 times sales currently, Nvidia’s rich valuation hinges on its stellar growth, justifying the premium.

The buoyant AI chip segment presents a lucrative growth avenue, potentially prompting the market to assign an elevated sales multiple to Nvidia in the future. Even with a discounted sales multiple of 25, Nvidia’s projected revenue of $131 billion could sustain its ascent.

Comparatively, Apple’s earnings are expected to expand at a slower 11% annual rate over the next five years, contrasting with Nvidia’s projected 36% annual earnings growth. The smartphone market’s lukewarm performance and Apple’s delayed engagement with AI technologies position Nvidia favorably for further market gains.

Recent reports indicate a downturn in Apple’s iPhone sales in China, ceding ground to competitors like Huawei, which saw a 64% surge in sales. Samsung’s foray into AI smartphones with the Galaxy series signals a competitive edge over Apple, which is yet to unveil an AI-centric device.

With Microsoft already overtaking Apple in market cap, Nvidia’s upward trajectory suggests a potential shift in rankings, heralding a new era in the tech landscape.

Unleashing Nvidia: A Titan Rising Above Apple?

Nvidia’s Market Cap Poised to Soar

Market dynamics are shifting, pointing towards Nvidia’s market capitalization potentially reaching an astronomical $3.27 trillion. In the financial arena, where figures dance like warring gladiators, such a feat is no small accomplishment.

Apple vs. Nvidia: The Showdown of Titans

Comparing two Silicon Valley giants, Apple’s current barometer indicates a trading multiple hovering at 7 times sales, slightly above its five-year average. However, given its sluggish growth pace, awarding Apple a higher sales multiple seems akin to painting a souped-up sports car with molasses.

Should Apple manage to rake in a projected $413 billion in revenue next year while clutching onto its sales multiple, its market cap could land at $2.9 trillion, offering a bold prediction – Nvidia’s ascent could potentially, by 2025, propel it past Apple, positioning it as a colossus among tech behemoths.

Investor Insights and The “Magnificent Seven”

For investors, the ardor of decision-making boils down to a simple soupçon: Nvidia. The power play of stocks, this choice stands as a beacon amidst the blinding glare of possibilities.