Companies often initiate stock splits to enhance share affordability and liquidity without affecting fundamental value. Notable players in the AI and semiconductor sectors, like Nvidia, Broadcom, and Lam Research, have recently opted for stock splits. Amidst this trend, speculation is rising around Silicon Valley-based Super Micro Computer (SMCI) potentially joining the list.

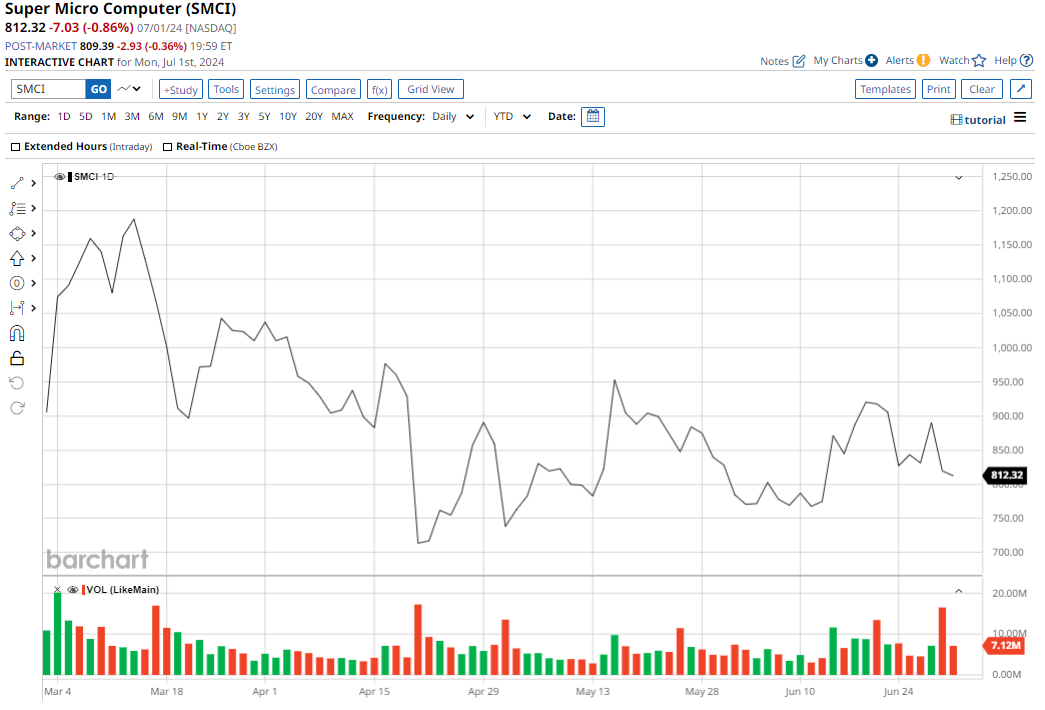

Super Micro Computer is a leading designer and manufacturer of energy-efficient, high-performance server solutions rooted in x86 architecture. Bolstered by robust demand for its full rack scale solutions, SMCI has witnessed a meteoric rise of over 4,000% in the past five years. The stock, which started as a Russell 2000 Index member, now boasts a market cap of $45.4 billion with a share price exceeding $800.

Thriving in a High-Growth Market

The AI server market is forecasted to hit $177.4 billion by 2032, propelled by escalating data storage needs in data centers driven by artificial intelligence. Super Micro is poised to capture a substantial market share, with analysts projecting its market share to surge to 17% by 2026 from 10% in 2023.

SMCI Hikes Revenue Guidance

SMCI has witnessed rapid growth, evidenced by recent entrance into the S&P 500. Its revenues have surged at a CAGR of 24.13% over a decade, while EPS expanded at a 36.70% CAGR. In Q3 of 2024, SMCI posted net sales of $3.85 billion, tripling the previous year’s revenue, with adjusted EPS soaring 329% to $6.65.

Ending the third quarter with significant cash reserves of $2.11 billion, SMCI raised its revenue guidance for the fiscal year to $14.7 billion to $15.1 billion.

Super Micro’s Competitive Edge

Super Micro’s ability to tailor server offerings to customer requirements stands as a key competitive advantage. Its modular approach, leveraging pre-designed components, allows for swift customization, outpacing competitors. Collaborations with industry giants like Nvidia, AMD, and Intel keep SMCI at the forefront of technology integration.

Liquid Cooling Adoption Set to Surge

SMCI’s pioneering use of liquid cooling in servers not only aligns with sustainability goals but also optimizes space utilization. Liquid-cooled servers, holding higher energy efficiency and reduced space requirements, position SMCI favorably amidst rising chip heat and energy consumption demands in AI servers.

The Rise of Super Micro: Innovating Cooling Technology and Strategic Growth

The Liquid-Cooled Data Center Revolution

Super Micro stands at the frontier of direct liquid cooling technology for data centers, set to ramp up production capacity to an impressive 2,000 directly liquid-cooled server racks per month by June’s conclusion, according to Bank of America projections. The anticipation of swift adoption of this technology, poised to feature in 30% of shipped racks next year from a meager 1% current market penetration, signals a monumental opportunity for Super Micro to stake a claim and fortify its dominant stance.

SMCI’s AI Expansion Advantages

Inhabiting a sector priming for future expansion fueled by Artificial Intelligence (AI), Super Micro occupies a smaller corner of the market compared to industry giants like HP (HPE) and Dell. However, its emphasis on Research and Development investment, ranging from 4% to 6% of revenues, outshines its bigger competitors hovering near 2-5%. To compete with behemoths such as HP and Dell, Super Micro engineers its servers for compatibility with an array of components and software from diverse vendors. This flexibility offers customers the freedom to select components tailored to their needs, potentially yielding cost savings against Dell or HPE alternatives.

Leveraging its proficiency in AI and agility in product introductions, Super Micro (SMCI) is poised to carve a larger market share amid industry expansion. As a nimble, fast-growing specialist in the flourishing data center domain, Super Micro is forecasted to emerge as a principal beneficiary of this overarching trend

Besides, Super Micro’s management envisions a promising future in sovereign AI, the deployment of AI by governments and public entities, holding optimistic outlooks not yet fully reflected in market forecasts. As highlighted by CFO David Weigand, escalating AI investments from both governments and enterprises in regions like EMEA and Europe suggest an impending surge in demand over the next year. This surge could ignite substantial growth for Super Micro in the AI server market.

Foreseeing SMCI’s Growth Trajectory

Glancing ahead, Super Micro’s growth predictions paint a robust picture. Analysts envisage the company’s prospective revenue growth around a staggering 65.71%, towering over the tech sector median of 6.61%. Correspondingly, operating profit and EPS growth are estimated at 88.79% and 82.70%, respectively, eclipsing the sector medians of 6.65% and 7%.

The earnings outlook is equally impressive, with a projected 122.45% growth in the ongoing fourth quarter culminating in June and a noteworthy 94.38% expansion anticipated for FY 2024.

Analysts’ Take on SMCI Stock

Market analysts radiate optimism regarding Super Micro’s stock, categorizing it as a “Moderate Buy” overall with a mean target price of $980.73, suggesting a potential upside of approximately 20.7% from current levels.

Among 13 analysts scrutinizing SMCI, 8 confer a “Strong Buy” rating, 4 advocate a “Hold” stance, while 1 dissents with a “Strong Sell” verdict.