In the wild world of finance, only a select few stocks have shown the panache to outshine others and soar to the stratosphere. These legendary equities, dubbed the “Magnificent Seven,” have set the bar high with remarkable performances. Witness their gravity-defying feat of quadrupling share prices, with some even achieving astronomical gains of close to 20,000% over the past decade.

While most members of this elite group have been riding the wave of technological innovation, standing head and shoulders above the rest is the enigmatic Tesla (NASDAQ: TSLA), the lone ranger with a weak performance, shedding roughly 16% of its value in the last three years.

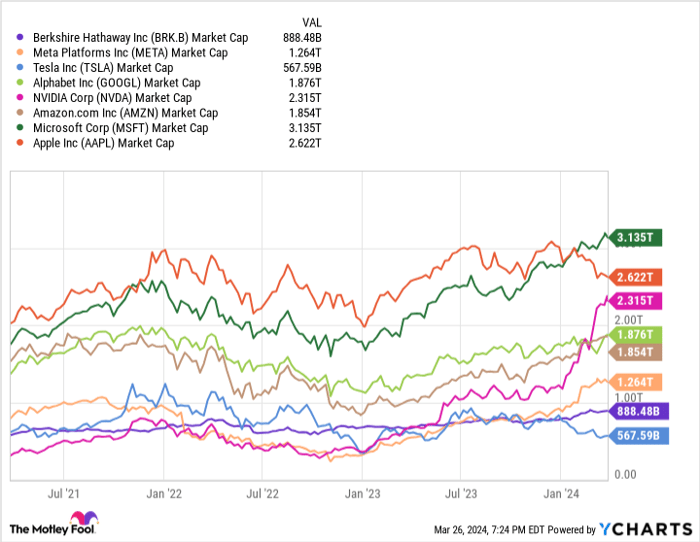

Enter Berkshire Hathaway, the dark horse in this high-stakes race, quietly amassing a market value of nearly $900 billion, positioning itself as a serious contender for the coveted $1 trillion club. Though not as steeped in tech mystique as its peers, it holds the promise of reaching this monumental milestone, potentially stealing Tesla’s thunder.

The Sleeping Giant Awakens

When pondering trillion-dollar behemoths, the mind conjures images of tech titans dominating the landscape. The illustrious Magnificent Seven – Alphabet, Meta Platforms, Apple, Amazon, Nvidia, and Microsoft – reign supreme, basking in the glow of technological supremacy. In this realm, Tesla, with its sub-trillion market cap, emerges as the odd duckling, the tech black sheep amongst its peers.

But lo and behold, Berkshire Hathaway, with its vast empire straddling the realms of insurance and investment, emerges as a formidable heir to Tesla’s throne. A mere 13% rise in its stock prices would catapult Berkshire into the exclusive $1 trillion league, possibly achieving this milestone in the imminent future.

Despite Tesla’s towering $570 billion market cap, Berkshire’s sheer size aligns better with the grandeur of the Magnificent Seven.

BRK.B market cap data by YCharts.

Curious minds may query — is Berkshire truly a tech entity, unlike Tesla? The answer might surprise you.

Primarily an insurance powerhouse with an investment wing, Berkshire’s publicly traded portfolio harbors a surprise gem – Apple, a jewel in the company’s crown worth a staggering $168 billion, nearly 30% of Tesla’s current market cap.

And that’s not Berkshire’s only tech dalliance. It boasts holdings in Amazon, Snowflake, Visa, Mastercard, HP, and Nu Holdings, with investments totaling billions of dollars. It even holds a stake in BYD, an electric vehicle manufacturer challenging Tesla’s dominance in China.

Though not as tech-centric as the Magnificent Seven, with tech holdings accounting for less than $200 billion, Berkshire emerges as a stealth tech player, flying under the radar for many.

In the Arena of Giants: Berkshire vs. Tesla

Directly comparing Berkshire and Tesla is akin to weighing apples against oranges, as each treads unique paths to financial success, demanding distinct valuation approaches. However, an analysis of their relative valuation vis-a-vis peers sheds light on an intriguing tale.

Compared to traditional auto stalwarts like Ford, General Motors, and Volkswagen, Tesla’s stock appears as a costly indulgence. Even when stacked against electric vehicle comrades like Rivian, Tesla sports a hefty premium.

TSLA PS ratio data by YCharts; PS = price to sales.

While Berkshire commands a premium in its domain, it pales in comparison to Tesla’s lofty valuations. Berkshire’s price-to-book ratios trade at a 20% to 50% over peers, while Tesla’s price-to-sales ratios soar nearly 200% above Rivian’s metrics.

BRK.B price-to-book-value data by YCharts.

Alas, Berkshire is unlikely to ascend to the hallowed Magnificent Seven club, lacking the tech fervor requisite for such an honor. Nevertheless, its hidden tech treasures make it an intriguing proposition.

Despite Tesla’s recent slump, its stock remains dear, with Berkshire’s shares offering a more grounded valuation, underpinned by a history of resounding success. While it may not secure a spot in the Magnificent Seven anytime soon, it merits a prime spot in your investment arsenal.

Envisioning the Future: A Berkshire Odyssey

Before embarking on a Berkshire voyage, ponder this:

The Motley Fool Stock Advisor expert squad has unveiled the ten best stocks with the potential for explosive growth, omitting Berkshire Hathaway. These chosen stocks hold the promise of stellar returns in the years ahead.

Stock Advisor equips investors with a roadmap to prosperity, offering insights into portfolio construction, analyst updates, and bi-monthly stock selections. Since 2002, the Stock Advisor service has tripled the S&P 500 returns*.

*Stock Advisor returns as of March 25, 2024