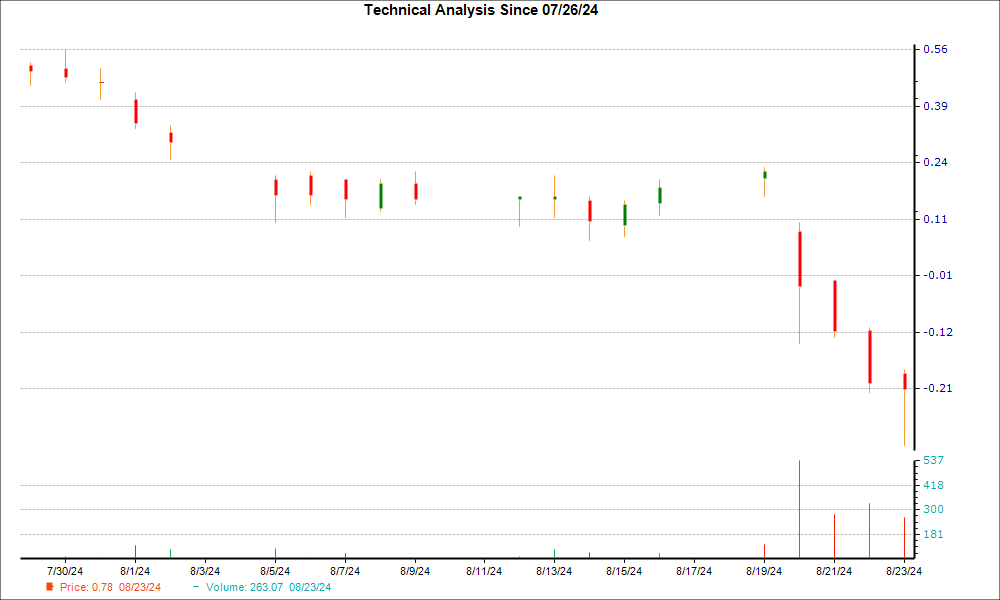

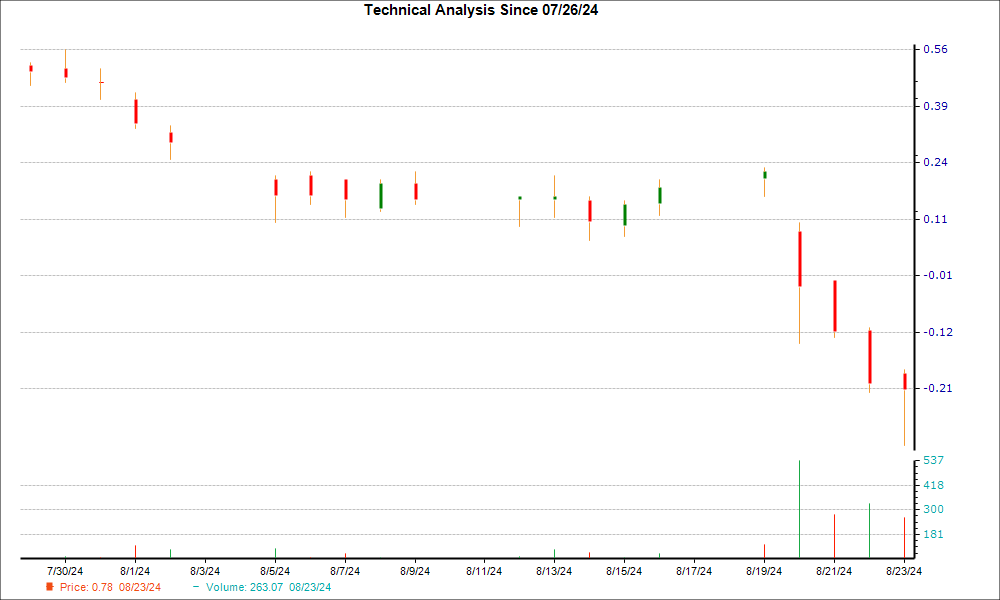

The recent trajectory of Workhorse Group’s stock symbol WKHS on NASDAQ has been bearish, experiencing a 33.6% decline over the past week. However, a hammer chart pattern emerged in its latest trading session, hinting at a potential trend reversal and the initiation of a support phase with strengthened bullish sentiment.

While the hammer pattern signifies a possible bottom and the exhaustion of selling pressure from a technical perspective, a more optimistic outlook from Wall Street analysts regarding the future earnings of this manufacturer of trucks and drones provides fundamental support for the stock’s anticipated reversal.

Decoding the Hammer Chart Pattern and Strategic Trading Methods

The hammer pattern is a well-recognized candlestick pattern in market analysis. It is characterized by a small candle body with a minor difference between the opening and closing prices, along with a long lower wick or vertical line that extends at least twice the length of the real body, resembling a hammer.

Succinctly put, during a downtrend when bears dominate, a stock typically opens lower than the previous close and closes lower as well. On the day the hammer pattern emerges, as the downtrend persists, the stock reaches a new low. However, a crucial shift occurs as buying interest emerges, halting the decline and pushing the stock to close near or slightly above its opening price.

Appearing at the downtrend’s nadir, the hammer pattern signals a potential shift in control from bears to bulls. The successful prevention of further price decline by bullish action indicates the likelihood of a trend reversal.

This candlestick formation can manifest on different timeframes and is relevant to both short-term and long-term investors.

Despite its usefulness, the hammer pattern is supplemental and should be used alongside other bullish indicators, given its reliance on chart positioning for strength.

Factors Enhancing the Prospect of a Reversal for WKHS

The recent uptrend in earnings estimate revisions for WKHS presents a significant positive fundamental indicator. Research supports the strong correlation between trends in earnings estimate revisions and short-term stock price movements.

Notably, over the past month, the consensus EPS estimate for the current year has surged by 22.5%. This increase reflects the consensus among sell-side analysts covering WKHS that the company will likely report better-than-expected earnings.

Adding to the positivity, WKHS currently holds a Zacks Rank #2 (Buy), positioning it in the top 20% of over 4,000 stocks ranked based on earnings estimate trends and EPS surprises. Stocks with Zacks Rank #1 or 2 traditionally outperform the market.

Furthermore, the Zacks Rank serves as a reliable timing indicator, aiding investors in identifying early signs of a company’s improving prospects. Therefore, Workhorse’s Zacks Rank of 2 stands as a corroborative fundamental indicator of a potential upturn.