Elon Musk’s SpaceX is venturing into new territory with a proposed $1.5 billion investment in Vietnam, as reported by the country’s government. This significant development comes after a hiatus in discussions dating back to 2023, reigniting talks at a later stage. In a recent statement, President To Lam expressed the Vietnamese government’s contemplation on SpaceX’s investment proposal, underscoring the potential partnership. Lam additionally urged Musk to expedite the investment process by collaborating with local entities.

The Orbital Odyssey: Continuation of Talks on SpaceX’s Expansion in Vietnam

SpaceX’s Starlink is gearing up to offer its revolutionary satellite network and communication services in Vietnam, a nation boasting nearly 100 million inhabitants, presenting a vast market for Starlink’s offerings. With Vietnam’s challenging topography and aging infrastructural setup threatening undersea cables, satellite services emerge as a fitting substitute for seamless internet connectivity across the nation. As SpaceX looks to deploy its satellite services, Tim Hughes, a government affairs representative, highlighted the mission to enhance educational initiatives and disaster management systems within Vietnam.

Recently, President Lam engaged in discussions with Tim Hughes during a meeting in New York, further delving into the specifics of SpaceX’s investment plans. Nonetheless, precise details regarding the investment structure remain undisclosed at this stage. Previous negotiations had stalled due to disagreements over the ownership structure of the prospective SpaceX subsidiary in Vietnam, with the nation imposing restrictions on majority ownership by foreign entities, capping it at 50%.

Other American tech giants, including Meta’s Facebook, Alphabet, and Apple, are also eyeing Vietnam as a promising market to extend their global presence, aligning with the escalating competition in the region.

Among Musk’s diverse ventures, Tesla stands out as the sole publicly listed company. Updates and events concerning Musk’s other ventures, such as The Boring Company, SpaceX, and X, have frequently influenced Tesla’s stock performance.

Deciphering Tesla’s Velocity: Is Tesla Stock Worth the Investment?

In a recent announcement, Musk unveiled the date for Tesla’s highly-anticipated “We, Robot” robotaxi event scheduled for October 10 in Los Angeles.

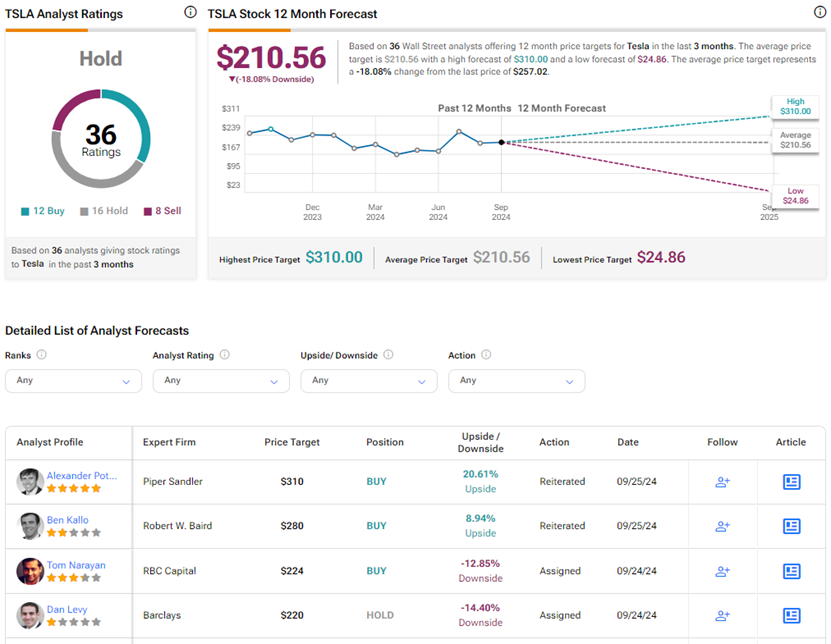

Despite this, analysts remain cautiously optimistic about Tesla’s stock, citing a deceleration in electric vehicle (EV) demand and intensifying competition within the EV sector. As per TipRanks data, Tesla’s stock currently holds a Hold consensus rating, comprising 12 Buy, 16 Hold, and 8 Sell ratings. At an average target price of $210.56 for Tesla, a downside potential of 18.1% from the current levels is projected. Year-to-date, Tesla shares have witnessed a modest 3.4% upsurge.

Explore more insights on TSLA analyst ratings

Kindly disregard any promotional links above