As Paramount navigates the aftermath of its recent deal with Skydance, a familiar figure emerges in the narrative – Barry Diller. Amidst the echoes of failed endeavors akin to Sony’s recent experiences, Diller’s involvement sheds light on the road less traveled by Paramount. With shares taking a slight dip in Monday’s trading session, investors seem less than enthused by the developments.

Diller, boasting a decade-long tenure at Paramount, saw a certain poetic justice in his bid for the company. Having previously vied for the studio only to lose to Sumner Redstone, he viewed his actions not as a mere whim but as an obligation. His pursuit, he stated, was driven by an innate sense of duty rather than personal desire.

Moreover, Diller hinted that his efforts to acquire Paramount stirred Skydance into action, ultimately leading to the deal’s conclusion. In a light-hearted twist, he humorously suggested that Shari Redstone should consider a gesture of gratitude, such as sending flowers or chicken soup, to acknowledge his catalytic role. However, Diller also acknowledged the shifting tides in Hollywood, with traditional powerhouses like Paramount waning in influence against the backdrop of emerging players like Apple.

Exploring Concluded Deals

In a different realm of deals, Paramount’s promotional discount for Paramount+ draws to a close today. The offer of a 50% discount for an annual subscription with the code FALL50 could influence the streaming service’s subscriber count for the quarter. The retention rate post the discounted period will undoubtedly be a key metric to watch, especially amidst economic uncertainties.

Adding a sprinkle of creativity to its ventures, Paramount has teamed up with children’s apparel retailer Andy & Evan to introduce a new line of SpongeBob SquarePants merchandise. Riding on the iconic character’s 25-year legacy, the collection will span from hoodies to bomber jackets, aiming to captivate fans old and new.

Assessing Paramount’s Stock Prospects

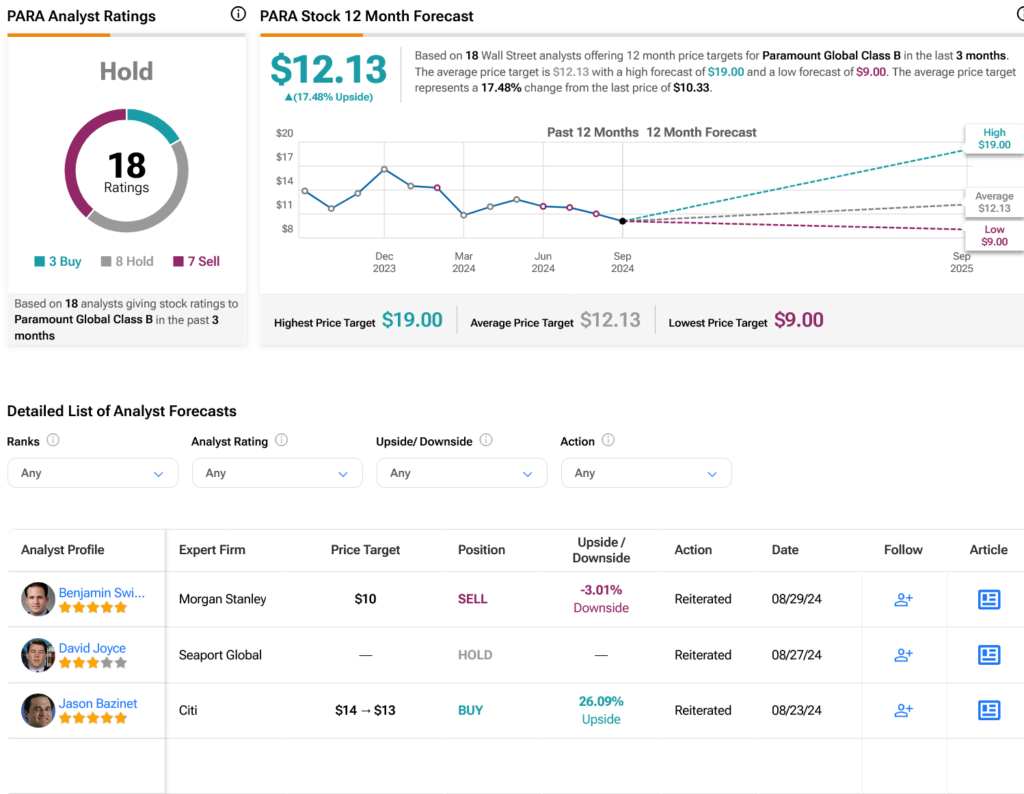

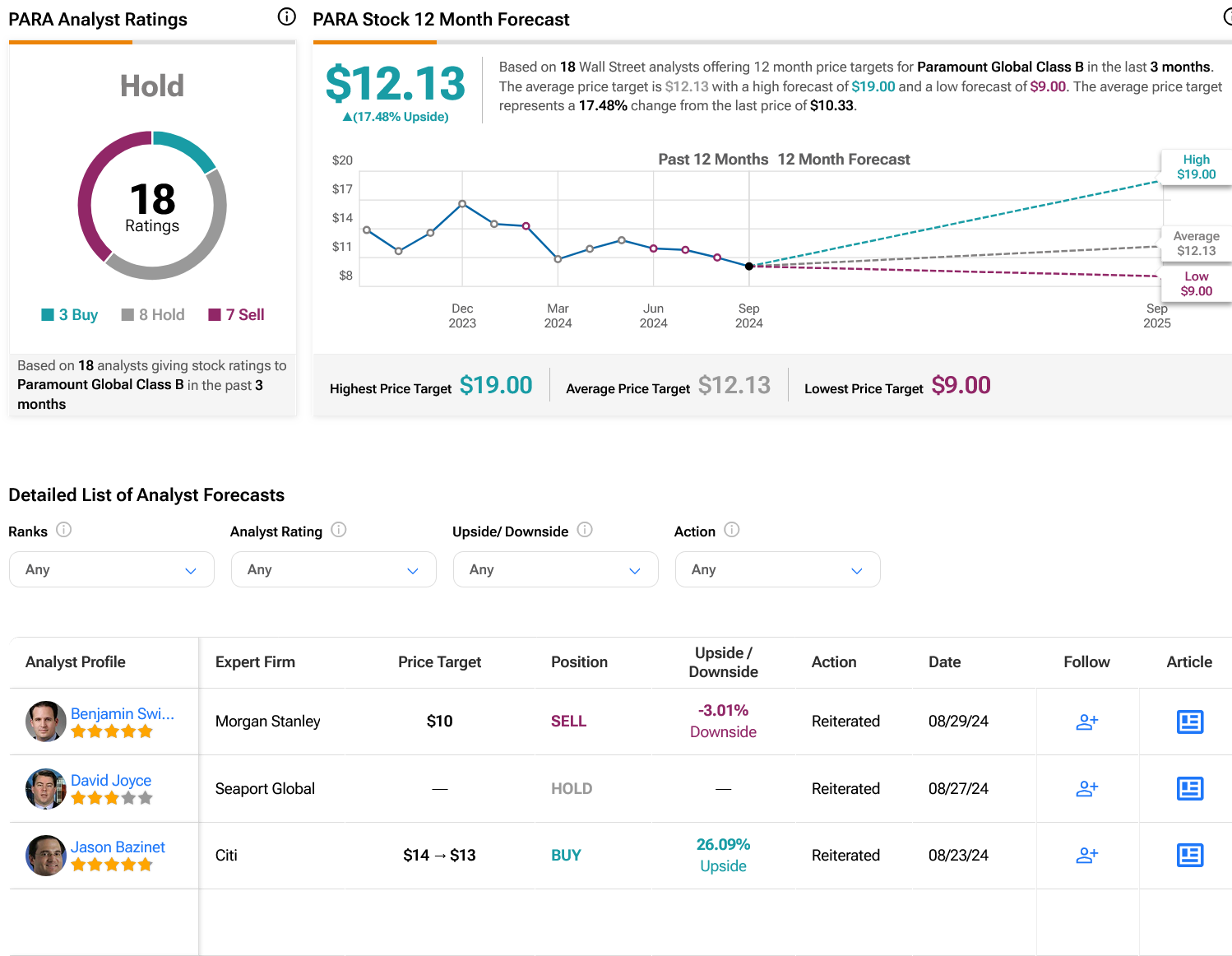

Shifting focus to the financial realm, Wall Street analysts currently hold a consensus Hold rating for PARA stock. Among the ratings issued in the last quarter, three Buy ratings, eight Holds, and seven Sells reflect a mix of sentiments. Despite a 17% decline in share price over the past year, the average price target of $12.13 per share implies a potential upside of 17.48%.

Curious to see more PARA analyst ratings? Explore further here